owner's draw vs salary

Payroll salaries are subject to income tax so owners dont have to worry about paying self-employment tax. 70000 contributions 30000 share of profits 15000 owners draw 85000 partner equity balance.

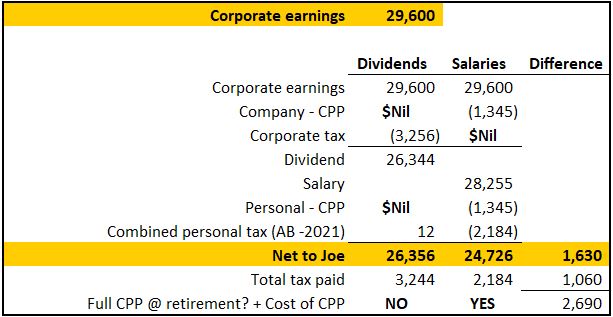

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

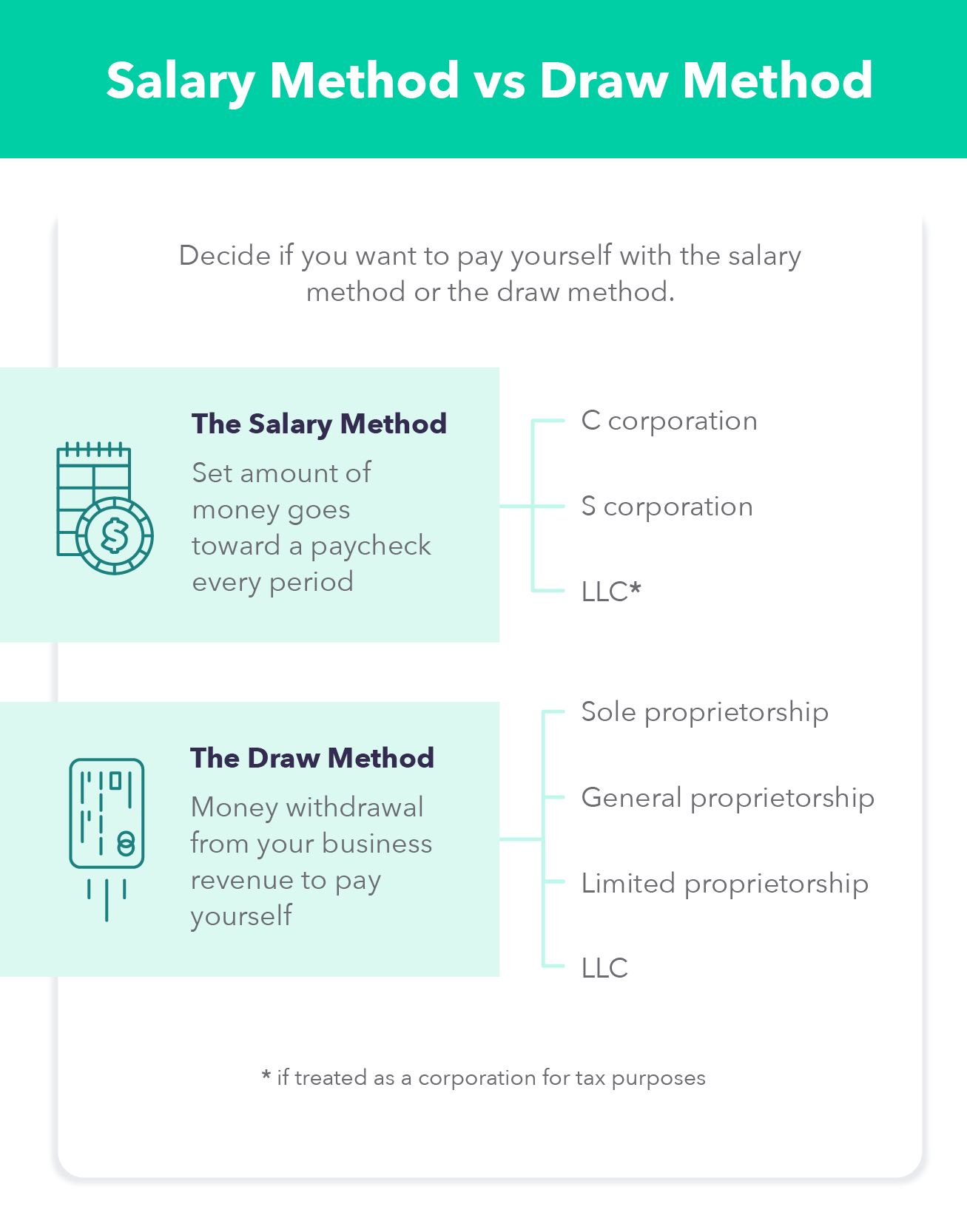

Your two payment options are the owners draw method and the salary method.

. Owners draws can be scheduled at regular. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

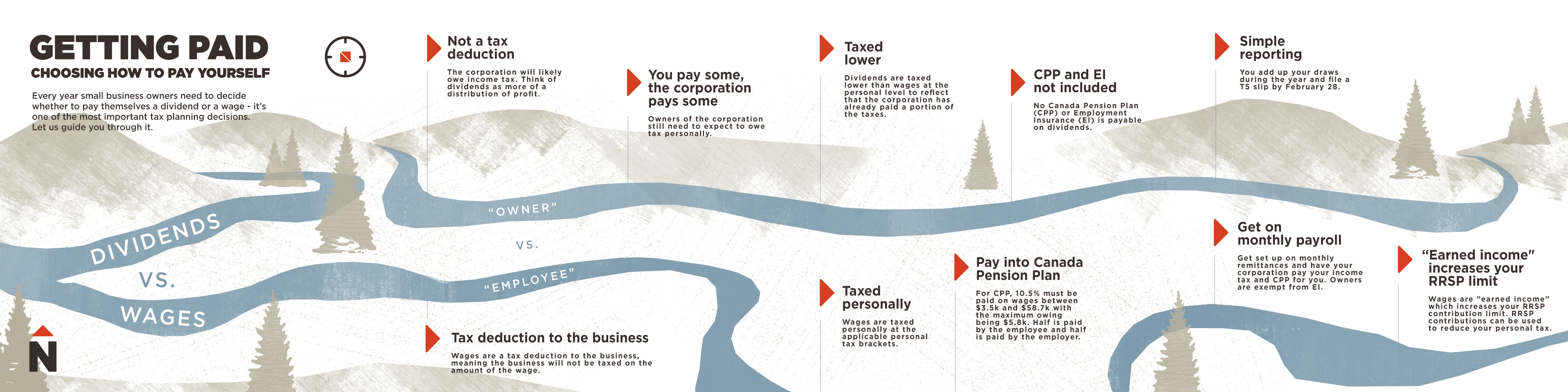

Business owners can choose to pay themselves via an owners draw or a salary or a combination of both. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Understand the difference between salary vs.

Owners loan Vs Draw Vs Dividends. As long as you keep your personal and business expenses separate ideally using separate bank accounts youre good. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every time you run payroll.

Since owner draws are discretionary youll have the flexibility to take out more or fewer funds based on how the business is doing. Owners draw vs salary. Owners Draw vs.

Through the salary method youll receive a fixed amount of money regularly as an employee. For large companies it is. An owners draw is not taxable on the businesss income.

Many small business owners compensate themselves using a draw rather than paying themselves a salary. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility.

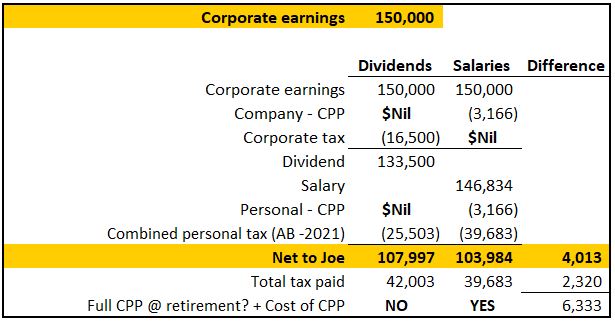

The bad news is that the dividend payment is not a tax-deductible expense. When should you use one over the other. A salary on the other hand is a set recurring payment that youll receive every pay period that includes payroll tax withholdings.

We have discussed owners draw v dividends so far. Many business owners opt to take a salary as a more stable form of payment. So to break it down again.

Taking Money Out of an S-Corp. When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a distribution. Payroll income with taxes taken out.

Clients and customers pay you you pay taxes done and done. Money taken out of the business profits. Owners Draw vs Salary.

If a C-corp business owner wants to draw money above his or her salary it must be taken as a dividend payment. Its a way for them to pay themselves instead of taking a salary. This is because the owners of those entities are considered.

In contrast the draw method allows you to withdraw from your owners equity account as your profits increase. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. Benefits To Being On Payroll.

Owners draws are usually taken from your owners equity. Here is her partner equity balance after these transactions. Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company.

Salary Vs Drawings Vs Dividends. In the former you draw money from your business as and when you see fit. Owners draws can give s corps and c corps extra tax savings.

What is an owners draw. As a business owner you can receive compensation for your work in your company through an owners draw or a salary. The two most common methods of compensation are an owners draw and a salary.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Keep in mind that a partner cant be paid a salary but a partner may be paid a guaranteed payment for services rendered to the partnership. Another similar concept to the owners drawings or distributions is the owners loan.

If youre a sole proprietor business owner or a partner or an LLC being taxed like one of these taking an owners draw is the easiest. An owners draw refers to an owner taking funds out of the business for personal use. First lets take a look at the difference between a salary and an owners draw.

In the latter method you take a salary just as any other employee. For varying reasons both decisions of draws and dividends have similar implications for a business. There are two main ways to pay yourself as a business owner owners draw and salary.

It should however be remembered that the IRS requires owners of S corporations to be paid reasonable compensation if they also act as officers andor employees of the company. Generally the salary option is recommended for the owners of C corps and S corps while taking an owners draw is usually a better option for LLC owners sole proprietorships and partnerships. Before you make the owners draw vs.

You dont need a salary because you have the flexibility to increase and decrease your draw depending upon your wants and needs. Up to 32 cash back Since the C-corp is typically owned by shareholders the earnings of the C-corp are owned by the company. In addition payroll counts.

How To Pay Yourself As A Business Owner Xero Ca

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Owner Draw Vs Salary Paying Yourself As An Employer

Quickbooks For Contractors Tip Basics Of Progress Invoicing Quickbooks For Contractors Blog

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

How To Pay Yourself Dividends Vs Wages Olympia Benefits

Salary Payyourself Selfemployed Smallbusiness Taxes Salary Business Performance Sole Proprietor

How Men And Women View Money Differently Infographic

Restaurant Specific Chart Of Accounts For Quickbooks Windows Desktop

Product Manager Vs Product Owner Vs Project Manager Teamhood

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business In Canada Youtube

Stephen L Nelson S Small Business Tax Deduction Secrets Ebook Tactics And Tricks F Small Business Tax Deductions Business Tax Deductions Small Business Tax

How To Pay Yourself Dividends Vs Wages Olympia Benefits

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Entrepreneur Salary 5 Steps To Paying Yourself First Mintlife Blog

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks